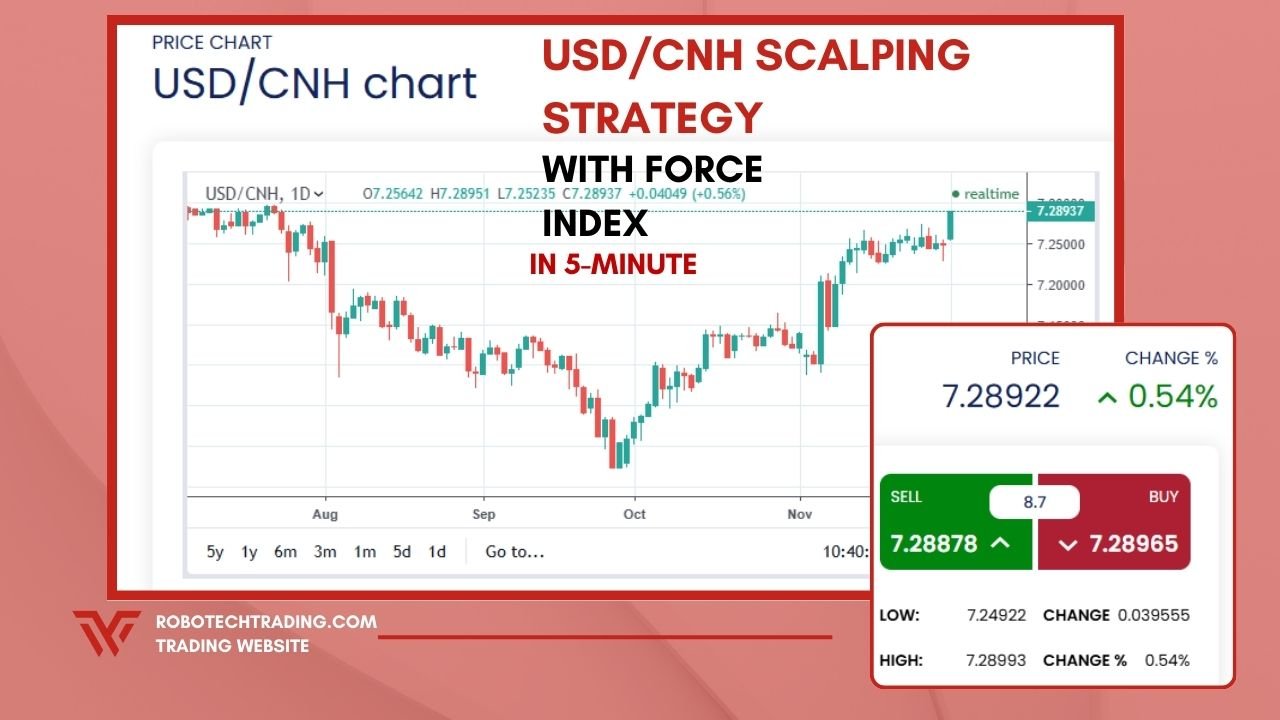

Scalping is one of the least time-sensitive trading techniques utilized in the high turnover FX market to make many profit-making businesses out of small price variations. The “Forceful Profits” uses the USDCNH currency pair features and applies the Force Index, an accurate variable for the strength of price trends. E-mini trading strategy: This approach offers the trader several fast, lucrative trades at defined entry and exit points in the five-minute chart. Through the Force Index, traders can be able to understand the amount of demand and supply pressure in the market, which in turn helps them make better decisions and, therefore, maximize their gains as they operate in one of the most active and volatile markets in the whole world such as the forex market. In this article, we’ll explore how to apply a 5-minute scalping strategy to the USDCNH pair using the Force Index indicator with Assh.

Table of Contents

ToggleUnderstanding Force Index

The Force Index is a technical analysis tool that measures the amount of energy or “force” behind a price move. Dr. Alexander Elder created the Force Index to measure price movement in a market. It integrates the variation aspect, volume, and direction to give a complete picture of pressure on the market. A Force Index figure above zero means buying pressure in the previous session, and a Force Index figure below zero means there was selling pressure. The Force Index helps traders in their market for trend confirmation purposes, indicating points of reversal or even points of entry and exit in their trading activities. Using the price changes and trading volume, the Force Index shows the strength of forces within the market.

How to Calculate Force Index

The Force Index is calculated by multiplying the price change by the volume.

Identify the Inputs:

- Current Closing Price (C): First, note the closing price of the current period.

- Previous Closing Price (P): Second, note the closing price of the previous period.

- Volume (V): Third, note the trading volume of the current period.

Calculate Price Change:

Multiply by Volume:

- Firstly, multiply the price change by the volume to get the Force Index:

Pv= (C – P) \ Vt.

- Secondly, determine the difference between the current and previous closing prices:

PC=(C – P)

How to Trade with Force Index for USDCNH Scalping Strategy

To trade the USDCNH Scalping Strategy with the Force Index, follow these steps:

Step 1: Set up your chart for the USDCNH Scalping Strategy

- Firstly, choose the USD/CNH pair

- Secondly, set the time frame to 5 minutes

- Thirdly, add the Force Index indicator

Step2: Identify buy signals of the USDCNH Scalping Strategy

- Firstly, wait for the Force Index to rise above 0

- Secondly, wait for the Force Index to break above the previous high

- Thirdly, buy the USD/CNH pair

- Now, set the stop-loss below the recent low

- Finally, take profit at the next resistance level

Step 3: Identify sell signals of the USDCNH Scalping Strategy

- Firstly, Wait for the Force Index to fall below 0

- Secondly, wait for the Force Index to break below the previous low

- Thirdly, sell the USD/CNH pair

- Now, set stop-loss above the recent high

- Then, take profit at the next support level

Tips and Tricks

- Firstly, use multiple time frames to confirm signals

- Secondly, combine the Force Index with other indicators

- Thirdly, monitor economic news and events

Risk Management

Risk management is crucial when trading with the Force Index. Here are some tips to help you manage your risk:

- Set stop-loss orders

- Use position sizing

- Monitor your trading performance

Short Review

The Force Index-based USD/CNH 5-minute scalp trading strategy can be very helpful to the would-be trader who wants to make the most of short-term fluctuations in the price action. Through the Force Index, traders are likely to have a measure of how price-sensitive the force is and the right time to enter or exit the market. The strength of this strategy is that it helps to determine the direction of buying and selling pressure more quickly and easily. This scalping method can improve trading potential and profitability if other technical indicators and sound risk management are incorporated into the scalping technique. When used correctly, these tools can be used effectively to assist traders in making better decisions in the fluctuating forex market.