Let’s start with a 30-minute scalping strategy with Assh. The USDCHF currency pair, known as the “Swissie,” is popular among forex traders due to its liquidity and volatility. Scalping, a trading strategy that involves making multiple trades over a short period to profit from small price movements, can be particularly effective with this pair. Using pivot points, a technical analysis tool identifying potential support and resistance levels, you can enhance your decision-making process for 30-minute scalping strategies as a trader. By analyzing the pivot points, traders can identify key levels where the price will likely react, allowing for precise entry and exit points. This approach helps maximize profits while minimizing risks, making it a favored technique among short-term traders. This article will explore applying a 30-minute strategy to the USDCHF Scalp pair using pivot points.

Table of Contents

ToggleUnderstanding Pivot Points

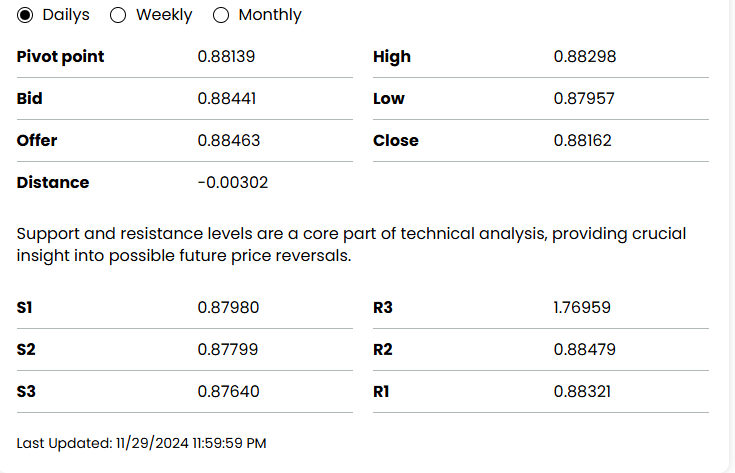

Firstly, we understand what is Pivot Points. Pivot points are a technical analysis tool that helps traders identify potential support and resistance levels. They are calculated based on the previous day’s high, low, and close prices.

How to Calculate Pivot Points

To calculate pivot points, follow these steps:

Step 1: Calculate the pivot point (PP)

Firstly, calculating pivot points involves using the previous trading day’s high, low, and closing prices. The primary pivot point (P) is calculated as the average of these three values:

PP = (High + Low + Close) / 3

Step-2: Calculate the support levels (S1, S2)

Secondly, you can determine the support levels from this central pivot point. The first level of support (S1) and second level of support (S2) are calculated as follows:

S1 = (2 × PP) – High

S2 = PP – (High – Low)

Step 3: Calculate the resistance levels (R1, R2)

Thirdly, For the resistance levels (R1 and R2), use the following formulas:

R1 = (2 × P) – Low

R2 = PP + (High – Low)

These pivot points and their support/resistance levels help traders identify potential entry and exit points by indicating where the price may experience support or resistance.

How to Trade with Pivot Points with USDCHF Scalp

Now we will know how you can trade with pivot points trading with USDCHF scalp. To trade with pivot points, follow these steps:

Step 1: Set up your chart for USDCHF Scalp

- Firstly, choose the USD/CHF pair

- Secondly, set the time frame to 30 minutes

- Thirdly, add pivot points indicator

Step2: Identify buy signals

- Now, wait for the price to bounce off S1 or S2

- Then, buy the USD/CHF pair

- Here, set stop-loss below the recent low

- Finally, take profit at R1 or R2

Step 3: Identify sell signals

- Firstly, wait for the price to break through R1 or R2

- Secondly, sell the USD/CHF pair

- Thirdly, set stop-loss above the recent high

- Now, take profit at S1 or S2

Tips and Tricks for USDCHF Scalp

- Firstly, use multiple time frames to confirm signals

- Secondly, combine pivot points with other indicators

- Thirdly, monitor economic news and events

Risk Management in USDCHF Scalp

Risk management is crucial when trading with pivot points. Here are some tips to help you manage your risk:

- Set stop-loss orders

- Use position sizing

- Monitor your trading performance

Review of Article

The USD/CHF 30-minute scalp using pivot points is a powerful strategy. You can maximize your trading potential by combining pivot points with other indicators and managing your risk.