The GBPJPY scalping strategy leverages the Heiken Ashi candlestick technique and the Average Directional Index (ADX) to capitalize on short-term price movements. Heiken Ashi candlesticks, known for their ability to filter out market noise, provide a clearer view of the underlying trend by averaging price data. This helps you identify potential entry and exit points more effectively. The ADX indicator complements this by measuring the trend’s strength, allowing you to distinguish between strong trends and ranging markets. Combining these tools allows you to make more informed decisions, enhancing your ability to profit from quick, short-term trades in the GBP/JPY market. This article will explore applying a scalping strategy to the GBP/JPY pair using Heiken Ashi and ADX indicators with Assh Malik.

Table of Contents

ToggleUnderstanding Heiken Ashi

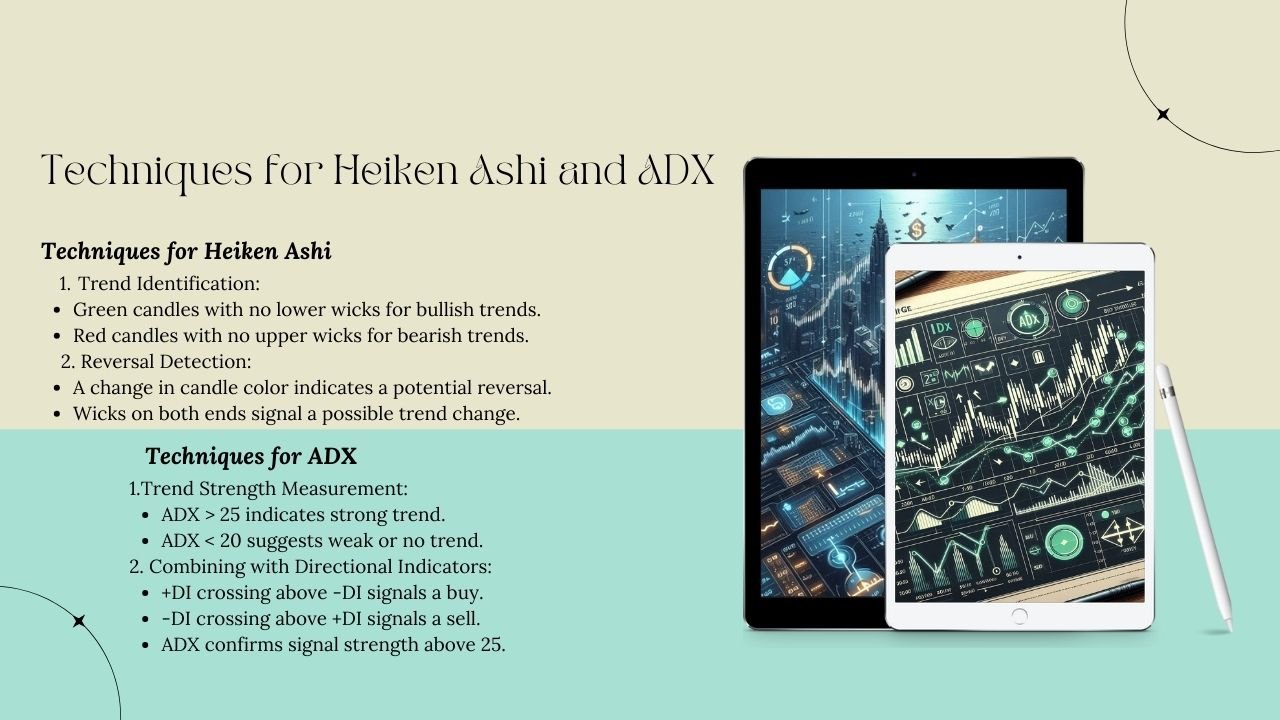

Heiken Ashi is a Japanese candlestick chart that helps you identify trends and potential reversals. It is used in technical analysis to better visualize market trends and potential reversals. Unlike traditional candlesticks, which display the open, high, low, and close prices for a given period, Heiken Ashi candles average these values, creating a smoother appearance that filters out market noise. This smoothing effect helps traders more easily identify the direction and strength of a trend, making it easier to spot trends and potential reversals. By understanding how Heiken Ashi works and incorporating it into their analysis, you can make more informed decisions and enhance your overall trading strategy.

Understanding ADX

ADX (Average Directional Index) is a momentum indicator that measures the strength of trends. It is a technical analysis indicator used to quantify the strength of a trend in the financial markets. J. Welles Wilder develops it. The ADX is part of the Directional Movement System, including the Plus Directional Indicator (+DI) and the Minus Directional Indicator (-DI). It is a single line that fluctuates between 0 and 100, with higher values indicating a stronger trend, upward or downward. The ADX helps traders determine whether the market is trending or ranging by measuring trend strength rather than direction.

How to Trade GBPJPY Scalping Strategy with Heiken Ashi and ADX

To trade GBPJPY Scalping Strategy with Heiken Ashi and ADX, follow these steps:

Step 1: Set up your chart GBPJPY Scalping Strategy

- Firstly, choose the GBP/JPY pair

- Secondly, set the time frame to 5 minutes

- Thirdly, add Heiken Ashi and ADX indicators

Step2: Identify buy signals

- Firstly, wait for Heiken Ashi to form a bullish reversal candle

- Now hold and wait for ADX to rise above 20

- Here, you can buy the GBP/JPY pair

- Set stop-loss below the recent low

- Finally, take profit at the next resistance level

Step 3: Identify sell signals

- Firstly, wait for Heiken Ashi to form a bearish reversal candle

- Secondly, wait for ADX to rise above 20

- Thirdly, sell the GBP/JPY pair

- Now, set stop-loss above the recent high

- Finally, take profit at the next support level

Tips and Tricks for GBPJPY Scalping Strategy

- Firstly, use multiple time frames to confirm signals

- Secondly, combine Heiken Ashi with other indicators

- Thirdly, monitor economic news and events

Risk Management for GBPJPY Scalping Strategy

Risk management is crucial when trading with Heiken Ashi and ADX. Here are some tips to help you manage your risk:

- Set stop-loss orders

- Use position sizing

- Monitor your trading performance

Review

The GBP/JPY scalping strategy, enhanced with Heiken Ashi candlesticks and the ADX indicator, offers a robust approach for short-term traders aiming to capitalize on the volatility of this currency pair. The Heiken Ashi candles provide a smoother representation of price movements, helping traders filter out market noise and identify trends more effectively. Meanwhile, the ADX indicator measures the strength of these trends, allowing traders to distinguish between strong trends and ranging markets. By combining these tools, traders can make more informed decisions, improving their entry and exit points and ultimately enhancing their profitability. This strategy requires precision, quick decision-making, and effective risk management, making it suitable for experienced traders comfortable with fast-paced trading environments.