If you’re looking for a simple and effective trading strategy that balances accuracy and profit, the EURAUD 4-hour scalping using the Bollinger Band Squeeze is a great choice.

If you’re into forex trading, you’ve probably heard of scalping. Scalping is about making quick trades to grab small profits from tiny price changes before the market moves. It can be exciting because you’re quickly in and out of the market, capturing little profits that can add up over time. Now, imagine using this scalping technique on the EURAUD currency pair. instead of looking at short timeframes like 1-minute Or 5-minute Charts, You’re Using A 4-hour chart. Interesting twist, right?

I’m going to walk you through a strategy called the Bollinger Band Squeeze. a simple but effective way to scalp EURAUD. Don’t worry, I’ll keep things easy to follow, almost like we’re just having a casual chat about trading.

Table of Contents

ToggleWhat is Scalping in Forex?

Let’s start with the basics. Scalping is all about jumping in and out of trades quickly, just trying to grab small profits from tiny price moves. It’s kind of like picking up loose change here and there, not a fortune with each one, but if you do enough, those small wins will start to add up.

Scalpers look for those moments when the price moves just enough to make a trade worth it. Once they’ve got their profit, they’re out. It’s like grabbing a good deal at a yard sale, quick and done. If you do scalping, you don’t wait for big trends. It’s like being ready to take advantage of small changes as soon as they appear. You act quickly and grab those small moves before they slip away.

Understanding Bollinger Band Squeeze for EURAUD 4-hour scalping

Okay, now let’s talk about the Bollinger Band Squeeze. You’ve probably seen Bollinger Bands. those curvy lines that hug the price on a chart. But here’s a quick refresher just in case:

Middle line: This is a simple moving average (SMA), typically set to 20 periods.

Upper and lower bands: These are placed above and below the middle line, usually two standard deviations away, which helps measure how volatile the market is.

When the market is calm, the upper and lower bands come closer together. this is the “squeeze.” When the bands get tight, it’s like the market is taking a deep breath, and when it exhales, the price often breaks out in a big way.

How to Calculate Bollinger Bands

Bollinger Bands are made up of three lines that help you see how the market is moving. Here’s how they work:

- The middle line is simply a 20-period simple moving average (SMA). It gives you an average price over the last 20 periods.

- The upper band is drawn by taking the middle line and adding a bit of extra room based on recent price movements, giving you an idea of the higher limit.

- The lower band is made by taking the middle line and subtracting some space to show how low the price might go.

These bands show you when the market is getting quiet or when a big move might be coming.

how to do EURAUD 4-hour scalping using the Bollinger band squeeze

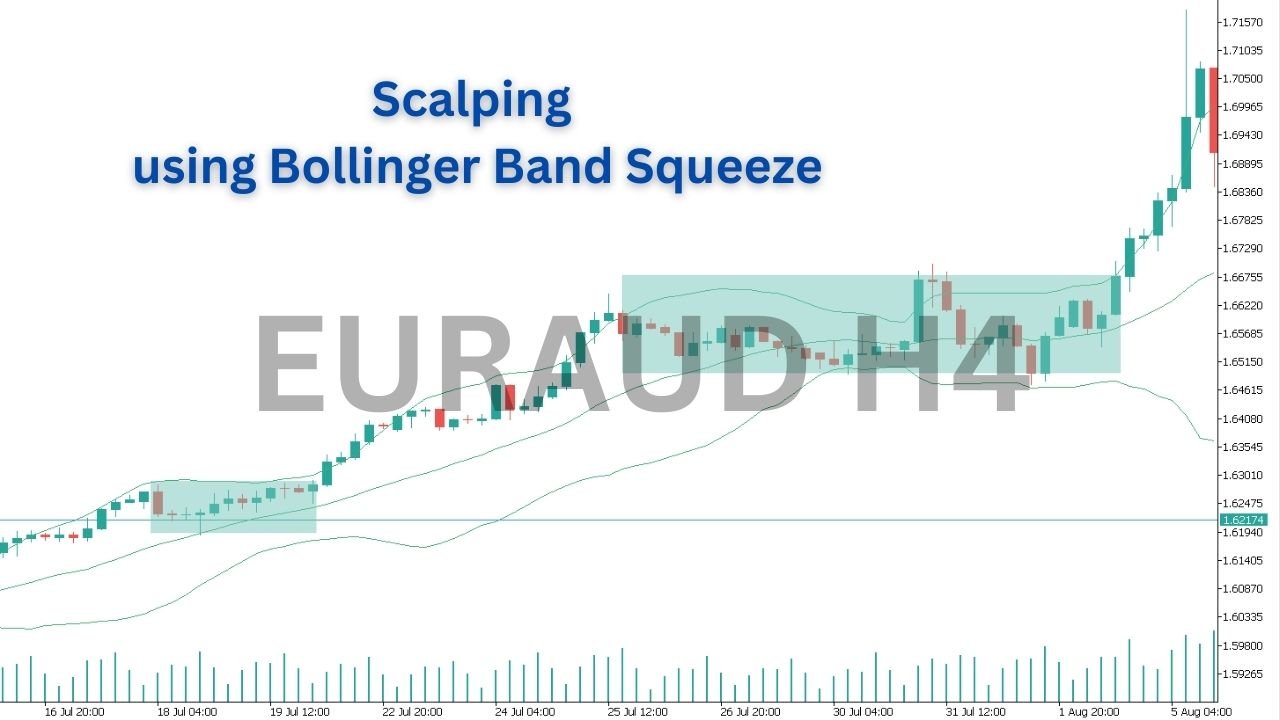

Here’s where it gets good for scalpers. The EURAUD pair moves a lot, so you get many chances to enter and exit trades. It’s like the market is always giving you chances to trade. Instead of watching the charts all the time, you’ll use the 4-hour chart. This helps you easily spot when the bands squeeze together, signalling that a big price move might be on the way. Here’s how we can use this in our trades:

Set Up Your Chart

- Firstly, pick the EURAUD pair.

- Secondly, set your chart to a 4-hour timeframe. This way, you get a clearer view without having to check the chart constantly.

- Thirdly, add Bollinger Bands with the default settings: a 20-period SMA and 2 standard deviations.

find the Squeeze

- Okay, now watch for moments when the Bollinger Bands get close together. This tells you that the market is calm and not much is happening.

- Once the bands start to move apart again, it usually means the price is about to make a big move.

Look for Buy Signals

- After that, wait until the price closes above the upper band. This is a signal that the price might go up.

- Then, indicators like RSI or MACD can be used to confirm that the breakout is real.

- Once you’re sure, go ahead and buy the EURAUD.

- Don’t forget to set a stop-loss just below the lower band or a recent support level to protect yourself if the trade goes the other way.

- And finally, set your take-profit at the next resistance level or use a 1:2 risk-reward ratio. For example, if your stop-loss is 20 pips, aim for 40 pips profit.

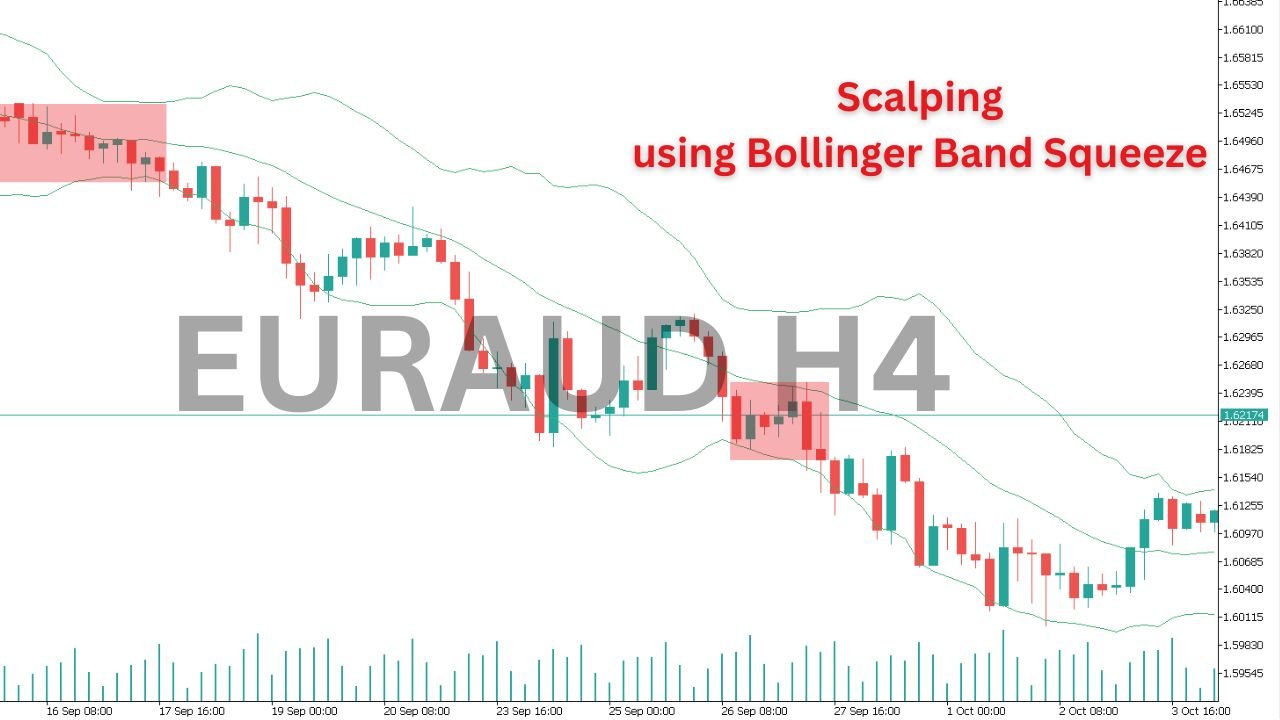

Look for Sell Signals

- On the other hand, if the price closes below the lower band, it’s a sign the price might drop.

- Then again, use RSI or MACD to confirm the breakout.

- When the signal is clear, go ahead and sell the EURAUD.

- The most important thing is to remember to set your stop-loss above the upper band or at the nearest resistance level to limit your risk.

- Finally, set your take-profit at the next support level or follow the same 1:2 risk-reward rule.

In short, by waiting for the right signals, confirming with other indicators, and managing our risk properly, we can trade with more confidence and better results.

Pro Tips for EURAUD 4-hour scalping

Here’s, we’ll teach you how to improve your strategy:

- Check multiple time frames to confirm signals. For example, use both the 4-hour and daily charts.

- Combine Bollinger Bands with other indicators like RSI or MACD for better accuracy.

- Stay updated on economic news that could impact the EURAUD pair to avoid surprises.

These steps can help you trade with more confidence and accuracy.

Risk Management for EURAUD 4-hour scalping

Alright, now that we’ve already covered how to spot the Bollinger Band Squeeze, let’s talk about something super important—risk management. After all, we should protect our money while we trade.

First, you set stop-loss orders to limit how much you could lose on a trade. This is like your safety net, helping you get out if the trade goes against you.

Second, position sizing is basically about being smart with your money. You risk only a small amount on each trade so that if things don’t go as planned, it won’t hurt too much. It’s a simple way to protect yourself and keep trading without stress This helps you keep getting better while staying safe with your money.

Short Recap

The EURAUD 4-hour scalp is a great strategy that uses the Bollinger Band Squeeze to find good trading opportunities. When you combine this with other indicators and smart risk management, it boosts your chances of making profitable trades. It’s a simple yet powerful way to improve your trading game